Once the new page has loaded click on the relevant income tax form for the year. Answer 1 of 5.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Meanwhile for the B form resident individuals who carry on business the deadline is 15 July for e-Filing and 30 June for manual filing.

. You will then be asked to create a new password for your new online account make sure its a secure one. How to file your income tax Non-residents filing for income tax can do so using the same method as residents. The first part is about the preparation and things you SHOULD know before filing your tax retu.

How to Declare Income. Submit the form along with a copy of your identification MyKad or other IDs and your salary details EAEC Of course you can also register using the. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

Valuations of some types of employment income are as follows. 2 Logging in to e-Filing You can access e-Filing through ezHASiL or your tax dashboard MyTax. Yes you should submit your e-filing via the LHDN website.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing. Firstly the total of all your incomes in the whole tax year will be added. On the Income Tax Return page youll see.

Fill up this form with your employment details. How to Declare Income. On the First 5000 Next 15000.

Your EA form will be provided by your employer and it will contain the details of how much income youll need to declare as an employee. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income. Start e-filing Click on the menu ezHasil services menu on the left-hand side of the screen then select e-filing.

For ease of filing you can use ezHasil to file your taxes online. Heres a more detailed guide on how you should go about registering as a first-time taxpayer. At the IRB office ask for the form to register a tax file.

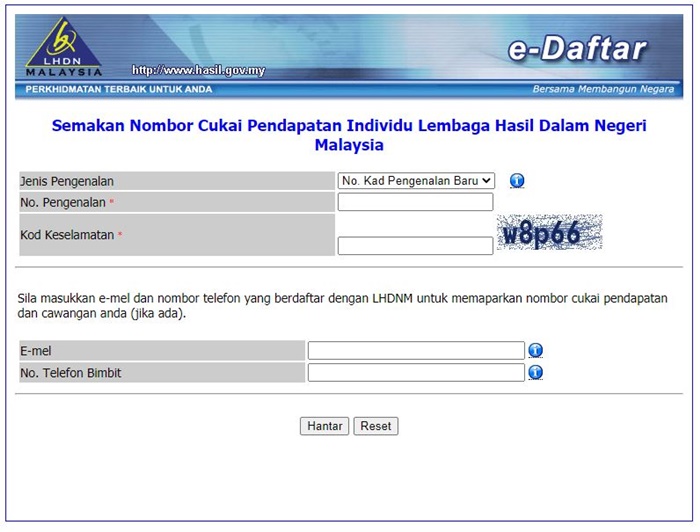

Use e-Daftar and register as a taxpayer online To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website where you can conveniently carry out the process online. Tax exemptions and reliefs are discounts you can get for certain expenses made in the year. For example if your total taxable amount is just RM500 now you have to pay RM1500 because of the 300 penalty.

Notice of assessment wil not be issued under SAS as the ITRF submission itself is the final assessment notice. Individual Life Cycle. Change if it does not display your latest information.

Headquarters of Inland Revenue Board Of Malaysia. How do I declare my taxes online. Ensure all your individual details are correct Ensure all your basic individual details displayed are correct.

On the First 5000. Declare your income details. Non-residents are taxed a flat rate based on their types of income.

However if you do receive gift or any non-employment in. Select Assessment Year from the drop-down menu. Long answer - If caught by the LHDNs auditor youll face a penalty ranging from 80 to 300 of the taxable amount.

If you are not a tax resident you would not enjoy income tax reliefs. On top of that therell be fines of RM1000 to RM20000 if the case is. Self assessment means that taxpayer is required by law to determine his taxable income compute chargeable income tax submit the income tax return form and make tax payment for the year of assessment concerned.

Go to e-BE Choose your corresponding income tax Form e-BE and choose the assessment year tahun taksiran 2015. Then if you qualify for any of the tax exemptions and reliefs those amounts will be deducted from your income amount. Arts and Culture Malaysia and entrance fees to tourists attractions incurred on or after 1st March 2020.

But you can declare your employment income as RM 000 in this way you are not required to pay tax to Malaysia LHDN as you will pay your tax to IRAS in Singapore. Hence the amount of total income earned would be your chargeable income which would be used to compute your final income tax payment at a flat rate of 28. Each company will issue a separate EA form so if you have worked for more than one company in one year you will have to have an individual EA form for each.

Calculations RM Rate TaxRM A. Youll need to upload a digital copy of your IC to serve as supporting document so it would be a good idea to prepare that beforehand. Jacks Income Tax Payments RM 100000 x 28 RM 28000.

This is a 2 part series on HOW TO FILE INCOME TAX in Malaysia. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. However you will be required to use the Form MMT Borang MMT instead of the Form BBE.

Select ITR Form Number from the drop-down menu. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. Donations are only tax deductible if they are made to a Government approved charitable organisation or directly to the Government.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. The PAN field will be filled in automatically. Thats a lot of money people.

For example if your chargeable income is RM55000 and youve donated RM2500 to an approved charitable organisation you are allowed to deduct 7 of. How to Declare Income. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

And you must keep the receipt of the donation. To get your income tax number youll need to first register as a taxpayer on e-Daftar. Introduction Individual Income Tax.

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. Examples of side businesses are plenty including online stores on e-commerce platforms blogging. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually.

Select Income Tax Return from the drop-down menu under the e-File heading. After that you can obtain your PIN online or by visiting a LHDN branch.

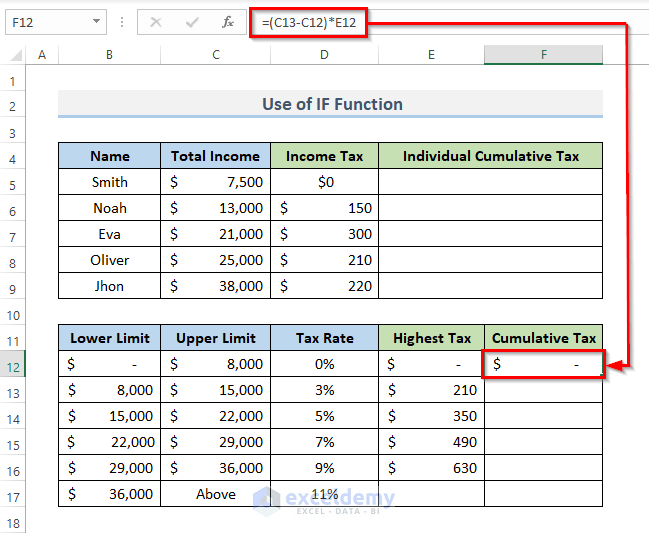

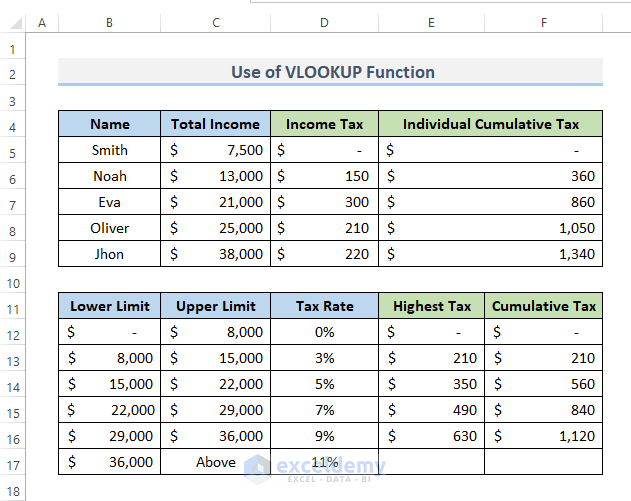

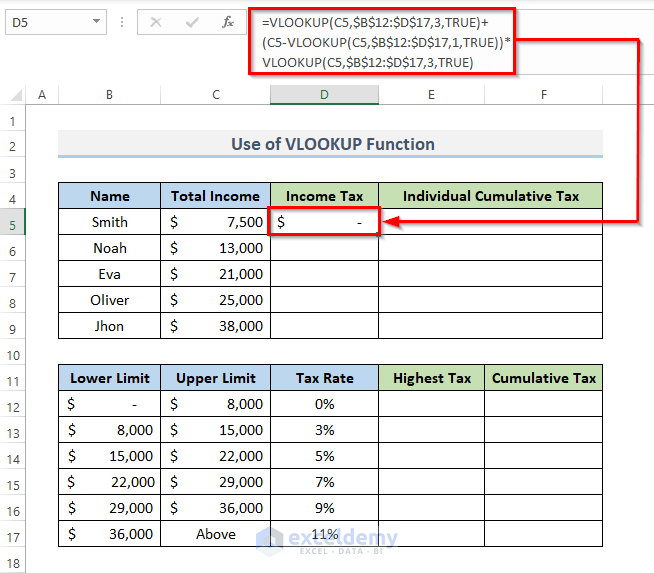

Computation Of Income Tax Format In Excel For Companies Exceldemy

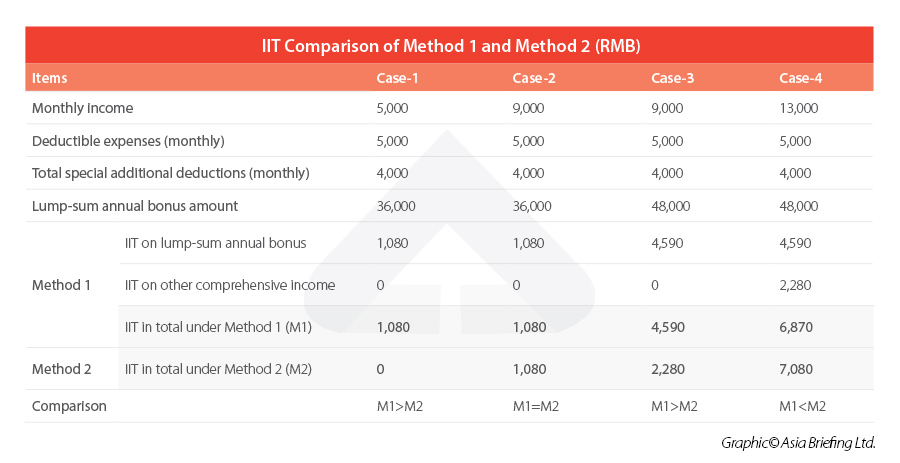

China Annual One Off Bonus What Is The Income Tax Policy Change

How To File Income Tax Return For Nri In A Few Simple Steps Ebizfiling

Watch This Before Filing Income Tax 2022 Pt 1 Complete Guide To File Tax Returns In Malaysia Youtube

Provision For Income Tax Definition Formula Calculation Examples

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

How To Calculate Income Tax In Excel

Guide To Using Lhdn E Filing To File Your Income Tax

Provision For Income Tax Definition Formula Calculation Examples

Computation Of Income Tax Format In Excel For Companies Exceldemy

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Computation Of Income Tax Format In Excel For Companies Exceldemy

How To Calculate Income Tax In Excel

P Cecilia I Will Provide Accounting And Tax Services Malaysia For 190 On Fiverr Com Accounting Services Tax Services Bookkeeping Services

Individual Income Tax In Malaysia For Expatriates

How To File Your Taxes For The First Time